30++ Vix spot price Mining

Home » Trading » 30++ Vix spot price MiningYour Vix spot price wallet are ready. Vix spot price are a news that is most popular and liked by everyone this time. You can News the Vix spot price files here. News all royalty-free news.

If you’re searching for vix spot price pictures information connected with to the vix spot price keyword, you have come to the ideal site. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and find more informative video content and graphics that match your interests.

Vix Spot Price. 102 rows Get historical data for the CBOE Volatility Index VIX on Yahoo Finance. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. VIX index spot values are the intraday values of the index only. The frequency of the VIX index values is every minute for data prior to 2004 and every 15 seconds including milliseconds from 2004 and after.

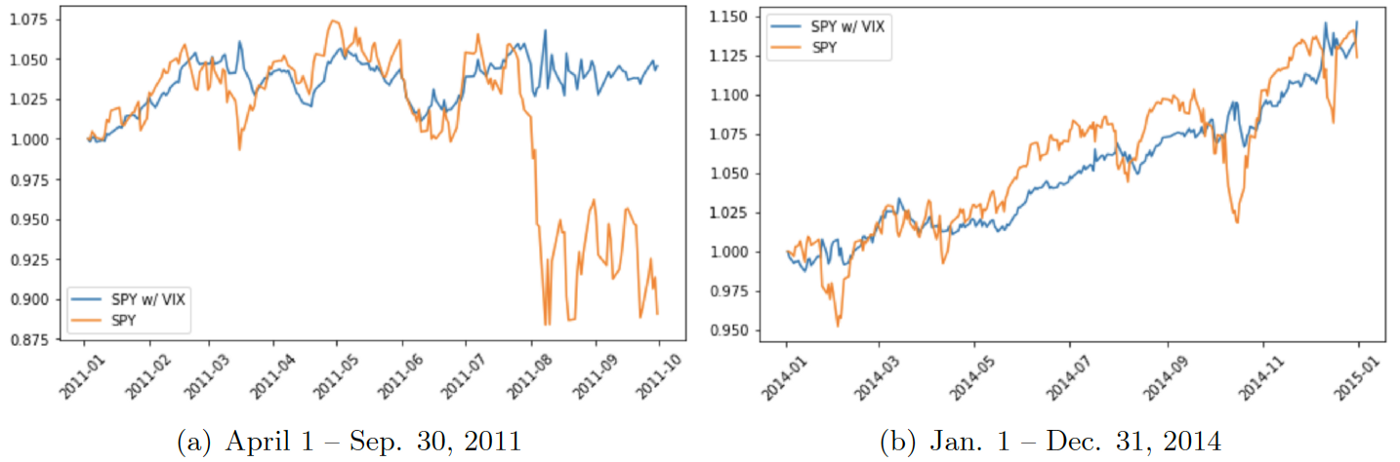

S P 500 Total Return Index And Vix The S P 500 Total Return Index Download Scientific Diagram From researchgate.net

S P 500 Total Return Index And Vix The S P 500 Total Return Index Download Scientific Diagram From researchgate.net

VIX A complete CBOE Volatility Index index overview by MarketWatch. Most of the time futures markets converge toward the spot prices as expiration approaches. 1224 at 2 standard deviations at 1pm 3 days before the meeting while premiums are high and sell at close 2 days before to profit. Assuming the VIX futures term structure is stable including the CBOEs VIX spot price allows us to project how much decaygain is built-in to the prices of the longinverse volatility ETPs. Historically the SP 500 VIX Short-Term Futures Index has a beta of 4878 with the VIX spot meaning it tracks about half of the spot movement on a daily basis. The VIX often referred to as the fear index is calculated in.

Gain of 15 running into the meeting.

The snapshot shows the VIX index and the May and June 2021 mini-contracts the VIX index is April. This information can help us set strike prices for option strategies set. The VIX spot and futures markets on the 10 trading days with the biggest market drops since Dec. Cboe currently calculates VIX Index spot values between 215 am. VIX index spot values are the intraday values of the index only. The spot price is the current market price for VIX a barrel of oil Bitcoin or any security.

Source: investopedia.com

Source: investopedia.com

You cant tell it from the chart but in this example the leftmost future has 4 days until expiration. Even if the spot price does not move the futures prices tend to decrease to match the spot price towards maturity contributing to a negative intercept. At expiration a VIX futures value will be very close to the VIX spot price. What this implies is that the market is pricing in the expected rise in the VIX Index in the months ahead. The opposite of Contango is Backwardation.

Source: pinterest.com

Source: pinterest.com

Gain of 15 running into the meeting. Sell an iron condor 2 standard deviations away from the spot price vix at 18. The reason lies in the term structure of VIX futures which is typically increasing in time-to-maturity. VIX index spot values are the intraday values of the index only. Get CBOE Volatility Index VIXExchange real-time stock quotes news price and financial information from CNBC.

Source: pinterest.com

Source: pinterest.com

VIX A complete CBOE Volatility Index index overview by MarketWatch. The VIX spot and futures markets on the 10 trading days with the biggest market drops since Dec. You cant tell it from the chart but in this example the leftmost future has 4 days until expiration. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days. Sell an iron condor 2 standard deviations away from the spot price vix at 18.

Source: in.pinterest.com

Source: in.pinterest.com

At expiration a VIX futures value will be very close to the VIX spot price. Get CBOE Volatility Index VIXExchange real-time stock quotes news price and financial information from CNBC. This means that in the next 23 days these two prices will converge to the same. The index value acts as price mechanism so if your strike price is 15 and the VIX is at 20 then your options intrinsic value would be 5. Historically the SP 500 VIX Short-Term Futures Index has a beta of 4878 with the VIX spot meaning it tracks about half of the spot movement on a daily basis.

Source: pinterest.com

Source: pinterest.com

This study also describes VIX futures trading above the VIX as contango or an upward sloped VIX futures curve and VIX futures trading below the VIX as backwardation or an inverted VIX futures curve. The index value acts as price mechanism so if your strike price is 15 and the VIX is at 20 then your options intrinsic value would be 5. Are intended to provide an indication of the fair market price of expected volatility at particular points in time. This data is available starting from January 1992. The snapshot shows the VIX index and the May and June 2021 mini-contracts the VIX index is April.

Source: blog.orats.com

Source: blog.orats.com

Settlement CBOE VIX futures are cash-settled and so unlike futures on commodities theres no physical delivery. VIX index spot values are the intraday values of the index only. View stock market news stock market data and trading information. Assuming the VIX futures term structure is stable including the CBOEs VIX spot price allows us to project how much decaygain is built-in to the prices of the longinverse volatility ETPs. Cboe currently calculates VIX Index spot values between 215 am.

Source: researchgate.net

Source: researchgate.net

If you were to hold it long-term even just going out 28 days you can see the VIX futures are trading at 1340. What this implies is that the market is pricing in the expected rise in the VIX Index in the months ahead. The horizontal green line shows the current VIX price also known as the spot price. Get CBOE Volatility Index VIXExchange real-time stock quotes news price and financial information from CNBC. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days.

Source: pinterest.com

Source: pinterest.com

When futures are in contango the longer the future has until expiration the higher its price. As you can see from the diagrams the current price of the VIX is 1524 while the price of the VX futures is 1860. As such these VIX Index values are often referred to as indicative or spot valu es. Of course in a real situation the intrinsic value would be supplemented by time value the longer until expiry the higher the time value. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days.

Source: researchgate.net

Source: researchgate.net

If you bought VIX today and the spot price was 11 but you look at the one-month futures contract and its at 14 you would need to somehow know that 30 days from now the spot price would be trading higher than 14 in order to make money on. This means that in the next 23 days these two prices will converge to the same. You can see that the VIX spot value is 1777 indicated by the green line. Are intended to provide an indication of the fair market price of expected volatility at particular points in time. Cboe currently calculates VIX Index spot values between 215 am.

Source: intelauthentic.com

Source: intelauthentic.com

The VIX spot and futures markets on the 10 trading days with the biggest market drops since Dec. What this implies is that the market is pricing in the expected rise in the VIX Index in the months ahead. Where S_t is the spot VIX price F_t is the VIX futures price. If you bought VIX today and the spot price was 11 but you look at the one-month futures contract and its at 14 you would need to somehow know that 30 days from now the spot price would be trading higher than 14 in order to make money on. The horizontal green line shows the current VIX price also known as the spot price.

Source: pinterest.com

Source: pinterest.com

102 rows Get historical data for the CBOE Volatility Index VIX on Yahoo Finance. As such these VIX Index values are often referred to as indicative or spot valu es. Historically the SP 500 VIX Short-Term Futures Index has a beta of 4878 with the VIX spot meaning it tracks about half of the spot movement on a daily basis. Are intended to provide an indication of the fair market price of expected volatility at particular points in time. You cant tell it from the chart but in this example the leftmost future has 4 days until expiration.

Source: pinterest.com

Source: pinterest.com

Settlement CBOE VIX futures are cash-settled and so unlike futures on commodities theres no physical delivery. You can see that the VIX spot value is 1777 indicated by the green line. Most of the time futures markets converge toward the spot prices as expiration approaches. The VIX spot and futures markets on the 10 trading days with the biggest market drops since Dec. The snapshot shows the VIX index and the May and June 2021 mini-contracts the VIX index is April.

Source: pinterest.com

Source: pinterest.com

It refers to the market condition in which the futures price is less than the spot price. It means that the near-term VIX futures are priced lower than the longer-term VIX futures. The VIX often referred to as the fear index is calculated in. Get CBOE Volatility Index VIXExchange real-time stock quotes news price and financial information from CNBC. Cboe currently calculates VIX Index spot values between 215 am.

Source: towardsdatascience.com

Source: towardsdatascience.com

The VIX is often in contango which happens when the futures price is higher than the current price. As such these VIX Index values are often referred to as indicative or spot valu es. There are many asset categories including oil and VIX where it is difficult or impossible to invest in the spot price. The spot price return is the change in the spot price from one period to the next. The VIX is often in contango which happens when the futures price is higher than the current price.

Source: pinterest.com

Source: pinterest.com

Of course in a real situation the intrinsic value would be supplemented by time value the longer until expiry the higher the time value. This means that in the next 23 days these two prices will converge to the same. You can see that the VIX spot value is 1777 indicated by the green line. Assuming the VIX futures term structure is stable including the CBOEs VIX spot price allows us to project how much decaygain is built-in to the prices of the longinverse volatility ETPs. Of course in a real situation the intrinsic value would be supplemented by time value the longer until expiry the higher the time value.

Source: towardsdatascience.com

Source: towardsdatascience.com

The VIX spot and futures markets on the 10 trading days with the biggest market drops since Dec. View stock market news stock market data and trading information. As you can see from the diagrams the current price of the VIX is 1524 while the price of the VX futures is 1860. VIX A complete CBOE Volatility Index index overview by MarketWatch. The CBOE Volatility Index VIX is a measure of expected price fluctuations in the SP 500 Index options over the next 30 days.

Source: investopedia.com

Source: investopedia.com

The VIX spot and futures markets on the 10 trading days with the biggest market drops since Dec. This means that in the next 23 days these two prices will converge to the same. Take a look at the chart above. At expiration a VIX futures value will be very close to the VIX spot price. Assuming the VIX futures term structure is stable including the CBOEs VIX spot price allows us to project how much decaygain is built-in to the prices of the longinverse volatility ETPs.

Source: pinterest.com

Source: pinterest.com

There are many asset categories including oil and VIX where it is difficult or impossible to invest in the spot price. Cboe currently calculates VIX Index spot values between 215 am. Take a look at the chart above. This information can help us set strike prices for option strategies set. Are intended to provide an indication of the fair market price of expected volatility at particular points in time.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title vix spot price by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.