20+ Nikkei stock average volatility index List

Home » Trading » 20+ Nikkei stock average volatility index ListYour Nikkei stock average volatility index exchange are obtainable. Nikkei stock average volatility index are a trading that is most popular and liked by everyone this time. You can Download the Nikkei stock average volatility index files here. News all free news.

If you’re searching for nikkei stock average volatility index pictures information linked to the nikkei stock average volatility index interest, you have come to the right blog. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Nikkei Stock Average Volatility Index. The current price is updated on an hourly basis with todays latest value. View stock market news stock market data and trading information. It has been calculated daily by the Nihon Keizai Shimbun The Nikkei newspaper since 1950It is a price-weighted index operating in the Japanese. Nikkei Average Volatility Index NKVFOS Osaka - Osaka Delayed Price.

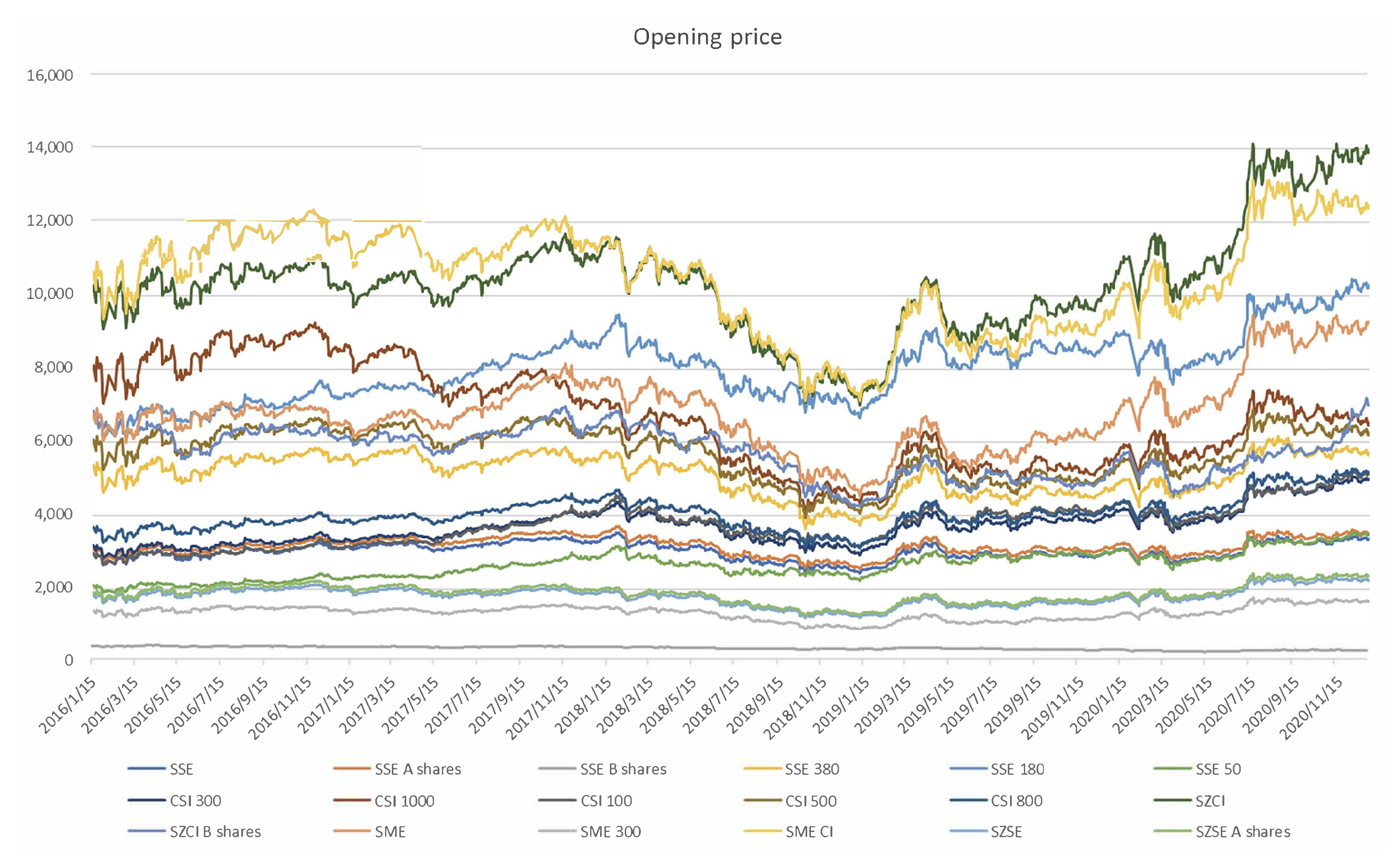

Trend Of Indonesia Sharia Stock Index Issi Source Indonesia Stock Download Scientific Diagram From researchgate.net

Trend Of Indonesia Sharia Stock Index Issi Source Indonesia Stock Download Scientific Diagram From researchgate.net

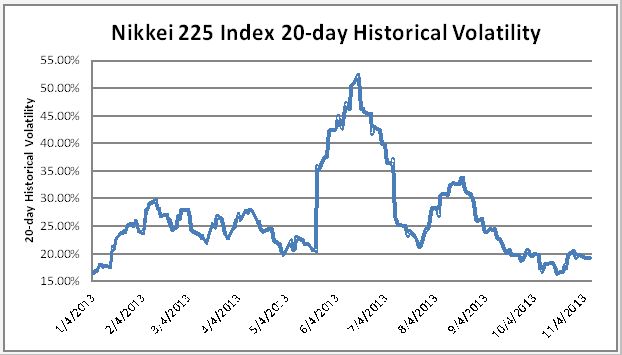

Nikkei Stock Average Volatility Index Spline-GARCH Volatility Analysis Whats on this page.

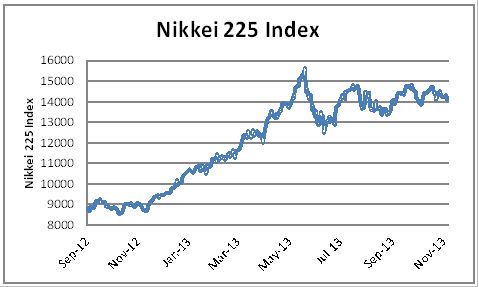

The Nikkei 225 or the Nikkei Stock Average 日経平均株価 Nikkei heikin kabuka more commonly called the Nikkei or the Nikkei index ˈ n ɪ k eɪ ˈ n iː- n ɪ ˈ k eɪ is a stock market index for the Tokyo Stock Exchange TSE. The new algorithm uses the Nikkei 225 Weekly option prices in addition to the Nikkei 225 option prices of the nearest two expiration months. Stock Price Index - Real Time Values. The Nikkei 225 VI indicates the expected degree of fluctuation of the Nikkei Stock Average Nikkei 225 in the future. The current price of the Nikkei 225 Index as of November 12 2021 is 2960997.

Source: researchgate.net

Source: researchgate.net

Nikkei Stock Average Volatility Index Spline-GARCH Volatility Analysis Whats on this page. Bloomberg – The Nikkei 225 Stock Average touched a level above 30000 for the first time since April as a reshuffle of the blue. The greater the index values are the larger fluctuation investors expect in the market. The current price is updated on an hourly basis with todays latest value. The new algorithm uses the Nikkei 225 Weekly option prices in addition to the Nikkei 225 option prices of the nearest two expiration months.

Source: mdpi.com

Source: mdpi.com

The current price is updated on an hourly basis with todays latest value. At the close in Tokyo. Nikkei Stock Average Volatility Index Nikkei 225 VI is an index indicating how the market predicts the market volatility will be in one month from the spot. It has been calculated daily by the Nihon Keizai Shimbun The Nikkei newspaper since 1950It is a price-weighted index operating in the Japanese. Each data point represents the closing value for that trading day and is denominated in japanese yen JPY.

Source:

Source:

NIK A complete NIKKEI 225 Index index overview by MarketWatch. Nikkei 225 Futures Large Contracts. All of the rights to the indices such as right to calculate publicize disseminate and use these indices are reserved by Nikkei Licensing agreement with Nikkei is necessary if compan ies intend to create Index - linked funds and passive funds etc. Nikkei Stock Average Volatility Index Nikkei 225 VI Opening Date. Calculation method The Nikkei Stock Average Volatility Index are calculated by using prices of Nikkei 225 futures and Nikkei 225 options on the Osaka Exchange OSE.

Source: pinterest.com

Source: pinterest.com

The Nikkei Stock Average Volatility Index is calculated in accordance with the following procedure. The greater the index values are the larger fluctuation investors expect in the market. Japan stocks lower at close of trade. Volatility Summary Table. The Nikkei Stock Average Volatility Index is calculated in accordance with the following procedure.

Source: id.pinterest.com

Source: id.pinterest.com

Japan stocks lower at close of trade. Note Orders are only accepted and not matched for 5 minutes before the Itayose on close. All of the rights to the indices such as right to calculate publicize disseminate and use these indices are reserved by Nikkei Licensing agreement with Nikkei is necessary if compan ies intend to create Index - linked funds and passive funds etc. Volatility Summary Table. The new algorithm uses the Nikkei 225 Weekly option prices in addition to the Nikkei 225 option prices of the nearest two expiration months.

Source: pinterest.com

Source: pinterest.com

Global Last Chg Chg. Nikkei 225 down 061. The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period. Bloomberg – The Nikkei 225 Stock Average touched a level above 30000 for the first time since April as a reshuffle of the blue.

Source: no.pinterest.com

Source: no.pinterest.com

Note Orders are only accepted and not matched for 5 minutes before the Itayose on close. The greater the index values are the larger fluctuation investors expect in the market. 10393 -257 -241 At close. Volatility Summary Table. Nikkei Stock Average Volatility Index Spline-GARCH Volatility Analysis Whats on this page.

Source: pinterest.com

Source: pinterest.com

8 nearest serial contract months. The current price of the Nikkei 225 Index as of November 12 2021 is 2960997. 764 of retail lose moneyThe Nikkei Indexes provide the information regarding all of the indexes calculated by Nikkei Inc represented by Nikkei Stock Average The Nikkei 225 Volatility Index is another separate index that represents the degree of fluctuation expected from the original Nikkei index in the future. Each data point represents the closing value for that trading day and is denominated in japanese yen JPY. Nikkei Stock Average Volatility Index Spline-GARCH Volatility Analysis Whats on this page.

Source: globalbankingandfinance.com

Source: globalbankingandfinance.com

Nikkei Stock Average Volatility Index Spline-GARCH Volatility Analysis Whats on this page. 764 of retail lose moneyThe Nikkei Indexes provide the information regarding all of the indexes calculated by Nikkei Inc represented by Nikkei Stock Average The Nikkei 225 Volatility Index is another separate index that represents the degree of fluctuation expected from the original Nikkei index in the future. Regulatory Measures etc Concerning Margin Trading. Nikkei Stock Average Volatility Index is an intellectual property that belongs to Nikkei. Volatility Summary Table.

Source: researchgate.net

Source: researchgate.net

At the close in Tokyo. Nikkei Stock Average Volatility Index Nikkei 225 VI is an index indicating how the market predicts the market volatility will be in one month from the spot. The Nikkei 225 VI indicates the expected degree of fluctuation of the Nikkei Stock Average Nikkei 225 in the future. Stock Price Index - Real Time Values. Nikkei Stock Average Volatility Index Nikkei 225 VI Opening Date.

Source: pinterest.com

Source: pinterest.com

Regulatory Measures etc Concerning Margin Trading. The current price is updated on an hourly basis with todays latest value. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. Volatility Summary Table. Nikkei 225 down 061.

Source: globalbankingandfinance.com

Source: globalbankingandfinance.com

Regulatory Measures etc Concerning Margin Trading. Daily Publication etc Concerning Margin Trading. At the close in Tokyo. Nikkei 225 Futures Large Contracts. NIK A complete NIKKEI 225 Index index overview by MarketWatch.

Source: researchgate.net

Source: researchgate.net

764 of retail lose moneyThe Nikkei Indexes provide the information regarding all of the indexes calculated by Nikkei Inc represented by Nikkei Stock Average The Nikkei 225 Volatility Index is another separate index that represents the degree of fluctuation expected from the original Nikkei index in the future. The 21-day SMA-based boring band is extremely wide demonstrating the volatility the market saw last month. Nikkei Stock Average Volatility Index Nikkei 225 VI Opening Date. Regulatory Measures etc Concerning Margin Trading. The Nikkei 225 or the Nikkei Stock Average 日経平均株価 Nikkei heikin kabuka more commonly called the Nikkei or the Nikkei index ˈ n ɪ k eɪ ˈ n iː- n ɪ ˈ k eɪ is a stock market index for the Tokyo Stock Exchange TSE.

Source: pinterest.com

Source: pinterest.com

The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. Nikkei 225 down 061. 8 nearest serial contract months. Daily Publication etc Concerning Margin Trading. 764 of retail lose moneyThe Nikkei Indexes provide the information regarding all of the indexes calculated by Nikkei Inc represented by Nikkei Stock Average The Nikkei 225 Volatility Index is another separate index that represents the degree of fluctuation expected from the original Nikkei index in the future.

Source: in.pinterest.com

Source: in.pinterest.com

Nikkei 225 Futures Large Contracts. Nikkei Stock Average Volatility Index Nikkei 225 VI is an index indicating how the market predicts the market volatility will be in one month from the spot. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. NIK A complete NIKKEI 225 Index index overview by MarketWatch. At the close in Tokyo.

Source: wikiwand.com

Source: wikiwand.com

October 22 630PM JST. The greater the index values are the larger fluctuation investors expect in the market. The Nikkei Stock Average Volatility Index signals the expected volatility of the Nikkei 225 in one month period. The Nikkei Stock Average Volatility Index indicates the expected degree of fluctuation of the Nikkei stock Average in the future. The Nikkei Stock Average Volatility Index is calculated in accordance with the following procedure.

Source: researchgate.net

Source: researchgate.net

The current price of the Nikkei 225 Index as of November 12 2021 is 2960997. October 22 630PM JST. Nikkei 225 VI Futures are futures contracts based on the Nikkei Stock Average Volatility Index Nikkei 225 VI which is an index calculated by Nikkei Inc estimating the degree of expected fluctuation in the Nikkei Stock Average. The greater the index values are the larger fluctuation investors expect in the market. Nikkei Average Volatility Index NKVFOS Osaka - Osaka Delayed Price.

Source: cmegroup.com

Source: cmegroup.com

The 21-day SMA-based boring band is extremely wide demonstrating the volatility the market saw last month. Volatility Prediction for Thursday October 28th 2021. View stock market news stock market data and trading information. Last week prices fell below the lower limit of the 21-day Bollinger Bands. Each data point represents the closing value for that trading day and is denominated in japanese yen JPY.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title nikkei stock average volatility index by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.