34++ Market chameleon volatility Trading

Home » Mining » 34++ Market chameleon volatility TradingYour Market chameleon volatility coin are available. Market chameleon volatility are a trading that is most popular and liked by everyone now. You can Get the Market chameleon volatility files here. Download all free trading.

If you’re searching for market chameleon volatility pictures information related to the market chameleon volatility interest, you have pay a visit to the ideal site. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Market Chameleon Volatility. The volatility skew shows you the difference in implied volatility IV between out-of-the-money options at-the-money options and in-the-money options. The platform offers various tools to identify potential trading opportunities. In this webinar we go into detail on trading volatility VOL using options straddlesYou can follow along with the data at. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other.

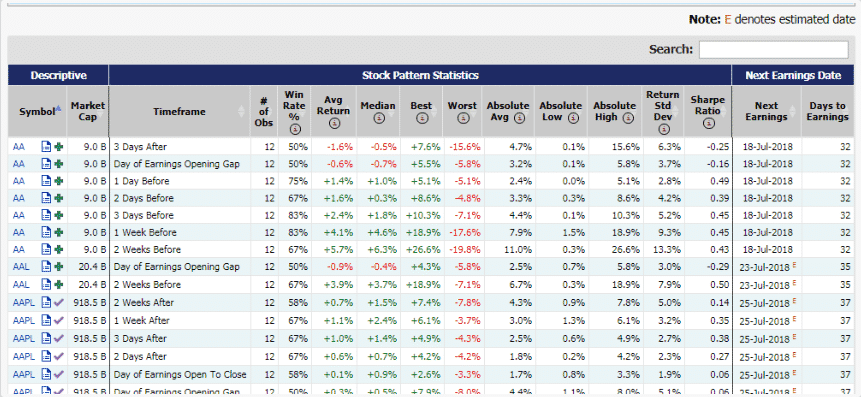

Theoretical Edge Learn Options Trading From marketchameleon.com

Theoretical Edge Learn Options Trading From marketchameleon.com

Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the. The platform offers various tools to identify potential trading opportunities. Skewの売りと買いの差 や インプライドボラティリティ を無料アカウント登録のみで確認できる. Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility.

The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day.

In this webinar we go into detail on trading volatility VOL using options straddlesYou can follow along with the data at. Interpreting the two Implied Volatility rows on the options tab of Market Chameleon. Skewの売りと買いの差 や インプライドボラティリティ を無料アカウント登録のみで確認できる. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. And will discuss how to find options with elevated subdued and moderate. In this webinar we go into detail on trading volatility VOL using options straddlesYou can follow along with the data at.

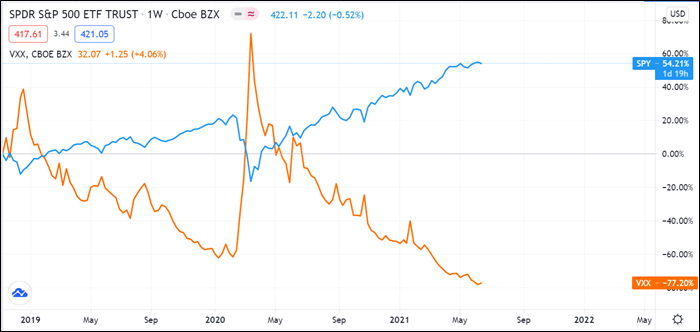

Source: daytradingz.com

Source: daytradingz.com

Market Chameleon is a platform built for stock traders and options traders. Market Chameleon is a platform built for stock traders and options traders. And will discuss how to find options with elevated subdued and moderate. JJM option chain the delta of each call option is in the left-most column of the table above. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other.

Source: in.pinterest.com

Source: in.pinterest.com

Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier. Placeholder text Scores TLDR Market Chameleon is useful especially if you plan to trade options. Market Chameleon is a web-based trading research site designed to take some of the guesswork out of stock and option analysis. Market Chameleon is a platform built for stock traders and options traders.

Source: mobile.twitter.com

Source: mobile.twitter.com

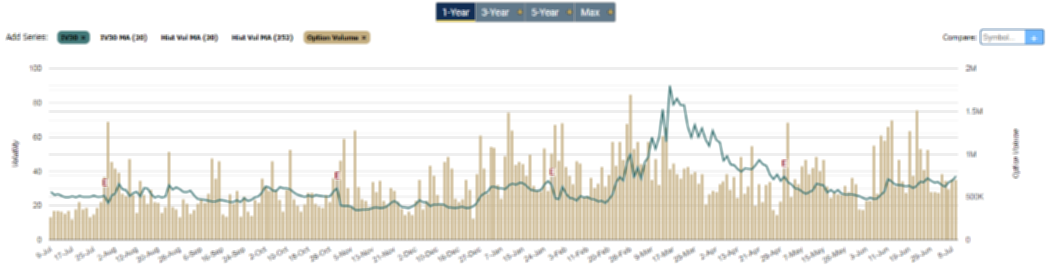

He will review implied volatility percentile rank implied volatility 52 week hilow position and comparing implied volatility to historical realized volatility. The platform offers various tools to identify potential trading opportunities. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier. Stock and option activity screeners earnings and dividend research. Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day.

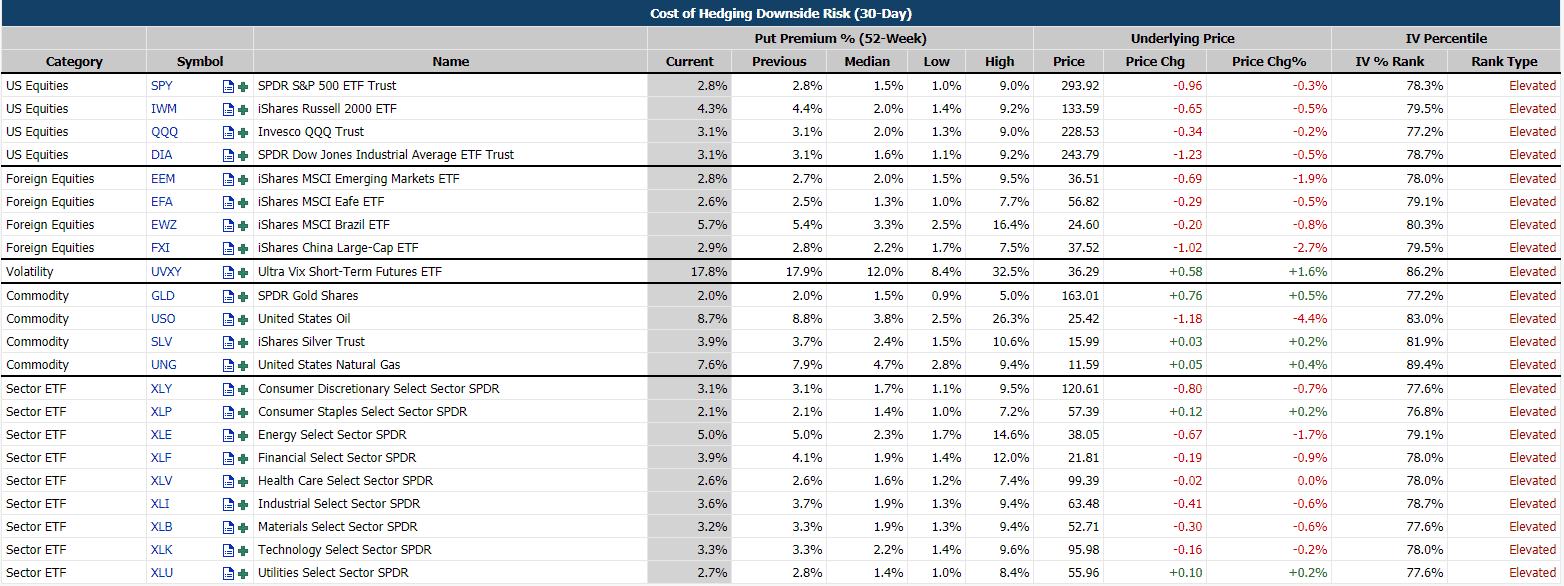

Source: marketchameleon.com

Source: marketchameleon.com

The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day. It means that the market expects the stock to be some percent away from its current price by the time the option expires. A stock that sees wide swings in its price is said to have a large amount of volatility as compared to a stock whose price stays in a narrow band. He will review implied volatility percentile rank implied volatility 52 week hilow position and comparing implied volatility to historical realized volatility. Correspondingly a delta of -075 means the option price would go down 075 if the the stock price goes up 1.

Source: optionstradingiq.com

Source: optionstradingiq.com

JJM option chain the delta of each call option is in the left-most column of the table above. Sign up for free. Placeholder text Scores TLDR Market Chameleon is useful especially if you plan to trade options. He will review implied volatility percentile rank implied volatility 52 week hilow position and comparing implied volatility to historical realized volatility. Investment insight and trade techniques for personal stock and option traders at an affordable price.

Source: daytradereview.com

Source: daytradereview.com

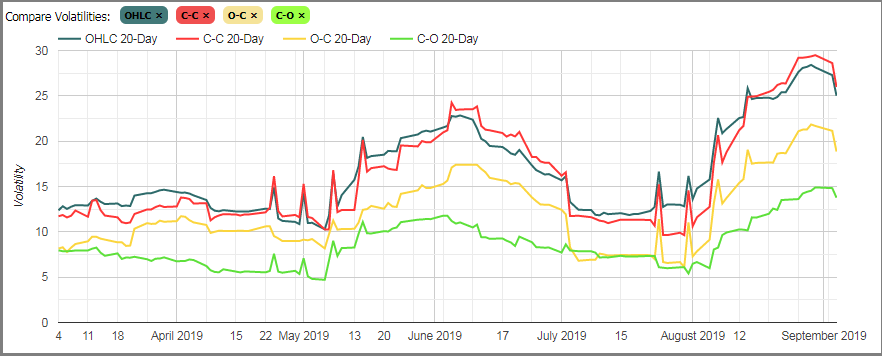

Correspondingly a delta of -075 means the option price would go down 075 if the the stock price goes up 1. Correspondingly a delta of -075 means the option price would go down 075 if the the stock price goes up 1. The following charts enable you to view the volatility skew for each option expiration listed for NAN comparing against other. The volatility skew shows you the difference in implied volatility IV between out-of-the-money options at-the-money options and in-the-money options. Market Chameleons Dmitry Pargamanik will look at using different methods to measure implied volatility levels.

Source: investopedia.com

Source: investopedia.com

The delta of each put option is in the right-most column of the table. Correspondingly a delta of -075 means the option price would go down 075 if the the stock price goes up 1. On Market Chameleons Ipatha Series B Bloomberg Industrial Metals Subind. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. The platform offers various tools to identify potential trading opportunities.

Source: youtube.com

Source: youtube.com

Correspondingly a delta of -075 means the option price would go down 075 if the the stock price goes up 1. The following charts enable you to view the volatility skew for each option expiration listed for TMCI comparing against other expirations and. Placeholder text Scores TLDR Market Chameleon is useful especially if you plan to trade options. The following charts enable you to view the volatility skew for each option expiration listed for NAN comparing against other. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the.

Source: marketchameleon.com

Source: marketchameleon.com

The following charts enable you to view the volatility skew for each option expiration listed for TMCI comparing against other expirations and. Sign up for free. The stock screeners layout is similar to the layout on Finviz which basically means that unless youve been trading for a while and are used to archaic user interfaces youll have to rub your eyes at first till you get. The delta of each put option is in the right-most column of. In this webinar we go into detail on trading volatility VOL using options straddlesYou can follow along with the data at.

Source: seekingalpha.com

Source: seekingalpha.com

The delta of each put option is in the right-most column of the table. As Market Chameleon summarizes Put options are a convenient way for investors to protect against investment losses in the event that an existing held equity position may be exhibiting increased volatility or risk of downward movement. The volatility skew shows you the difference in implied volatility IV between out-of-the-money options at-the-money options and in-the-money options. Market Chameleon Review Read More. Correspondingly a delta of -075 means the option price would go down 075 if the the stock price goes up 1.

Source: optionstradingiq.com

Source: optionstradingiq.com

The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day. JJM option chain the delta of each call option is in the left-most column of the table above. The volatility skew shows you the difference in implied volatility IV between out-of-the-money options at-the-money options and in-the-money options. Sign up for free. The platform offers various tools to identify potential trading opportunities.

Source: marketchameleon.com

Source: marketchameleon.com

Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. JJM option chain the delta of each call option is in the left-most column of the table above. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier. The following charts enable you to view the volatility skew for each option expiration listed for TMCI comparing against other expirations and. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other.

Source: investor-zenkichi.com

Source: investor-zenkichi.com

Interpreting the two Implied Volatility rows on the options tab of Market Chameleon. The delta of each put option is in the right-most column of the table. The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day. Accessibility is always at the forefront which is why it offers newsletters and simple screeners through a free starter tier. A stock that sees wide swings in its price is said to have a large amount of volatility as compared to a stock whose price stays in a narrow band.

Source: marketchameleon.com

Source: marketchameleon.com

The following charts enable you to view the volatility skew for each option expiration listed for SOFI comparing against other expirations and. The volatility skew shows you the difference in implied volatility IV between out-of-the-money options at-the-money options and in-the-money options. As Market Chameleon summarizes Put options are a convenient way for investors to protect against investment losses in the event that an existing held equity position may be exhibiting increased volatility or risk of downward movement. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Premier online resource for options and stock investment strategies and research.

Source: optionstradingiq.com

Source: optionstradingiq.com

Currently the stocks implied volatilitythe expected post-earnings move calculated from the implied at-the-money straddle of the expiration. Market Chameleons Implied Volatility Movers Report shows how the current implied volatility for a symbols particular option expiration has changed since the previous day. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Calculating the at-the-money implied volatility ATM IV is based on the strikes nearest to the at-the-money spot price and the change represents the difference from the. Special guest Jay Soloff of Options Floor Trader and Coffee Condors will join Market Chameleon founder Dmitry Pargamanik to talk about market volatility.

Source: marketchameleon.com

Source: marketchameleon.com

Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Currently the stocks implied volatilitythe expected post-earnings move calculated from the implied at-the-money straddle of the expiration. Investment insight and trade techniques for personal stock and option traders at an affordable price. The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day. And will discuss how to find options with elevated subdued and moderate.

Source: marketchameleon.com

Source: marketchameleon.com

The platform also has an interest scanner that displays stocks with high moderate or low implied volatility for the current trading day. The platform offers various tools to identify potential trading opportunities. JJM option chain the delta of each call option is in the left-most column of the table above. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Currently the stocks implied volatilitythe expected post-earnings move calculated from the implied at-the-money straddle of the expiration.

Source: youtube.com

Source: youtube.com

Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Skewの売りと買いの差 や インプライドボラティリティ を無料アカウント登録のみで確認できる. In this webinar we go into detail on trading volatility VOL using options straddlesYou can follow along with the data at. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other. Volatility skew is a measure of market implied volatility to both the upside and the downside and the comparison of how they relate to each other.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title market chameleon volatility by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.